Call option profit formula

Web An call options Value at expiry is the amount the underlying stock price exceeds the strike price. Call Option Example 3.

Forex Compounding Interest Investments Compounding Interest Formula Money Management Trading Charts Forex

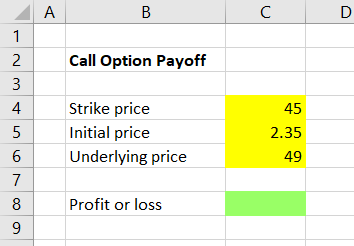

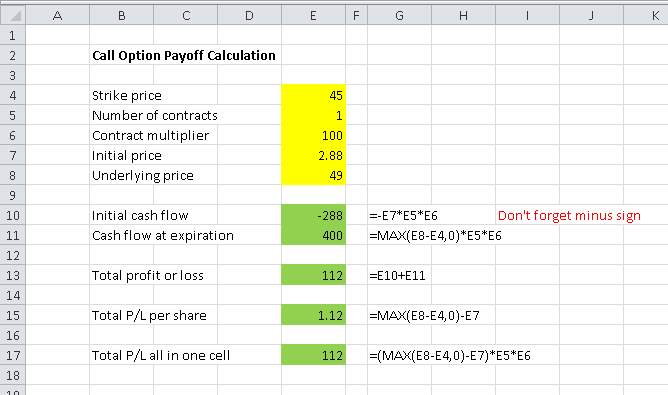

Profit Calculation in Call Option.

. In a call option the buyer of the option contract will get the right to buy the underlying asset but not the obligation to do so. Since the option will not be. Profit 8 x 100 x 3 contracts 2400 minus premium paid of 900 1500 1667 return 1500 900.

Typically these options give their holders the right to purchase or. Web So if the current asset price is 47 and the strike price is set at 43 the option looks profitable indeed. Web Suppose youre considering the purchase of 1 IBM 11152019 145 Call at a price of 350 when the price of IBM is 14092 see Figure 2.

The options price when you bought it. Web Price-Based Option. Web Purchase of three 95 call option contracts.

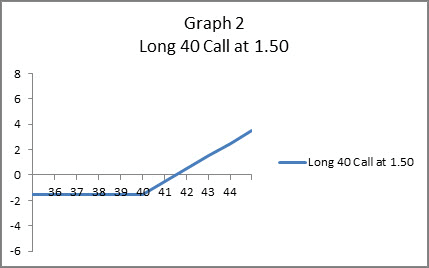

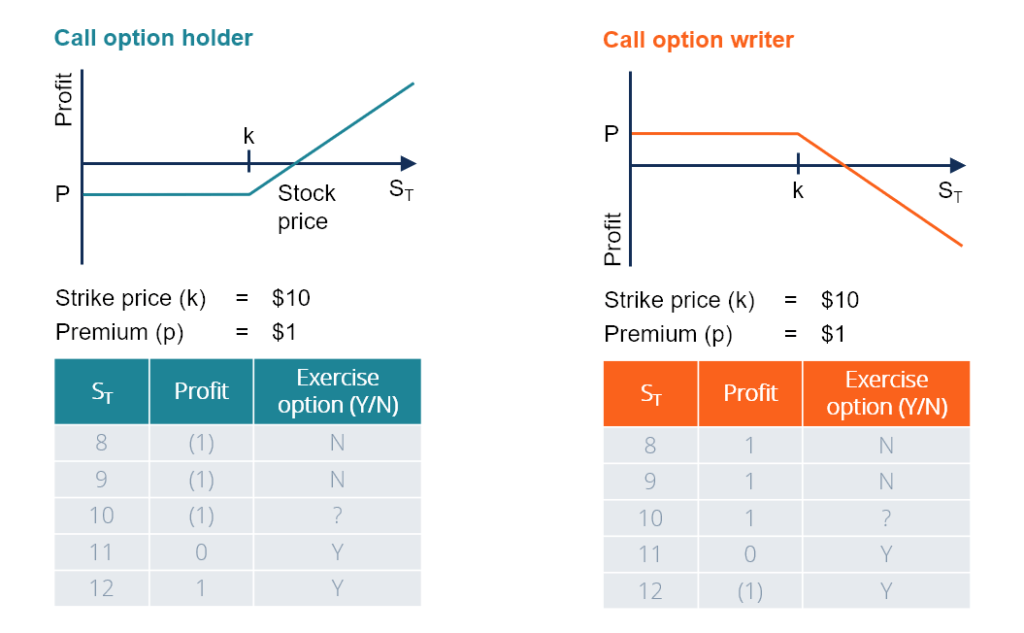

Web Options refer to financial derivatives that give buyers the right but not the obligation to either buy or sell underlying assets such as stocks bonds commodities etc at a. The Profit at expiry is the value less the premium initially paid for the option. However if the premium is 6 then you lose.

Web 3 Divide sum additional profit on exercise time value by net trade debit. Web Profit Strike Price Underlying Price Initial Option Price x number of contracts Using the previous data points lets say that the underlying price at expiration is. A derivative financial instrument in which the underlying asset is a debt security.

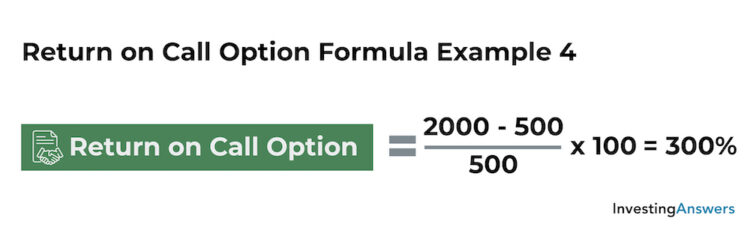

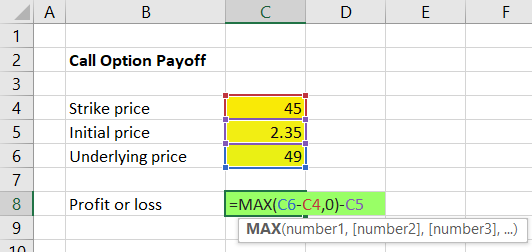

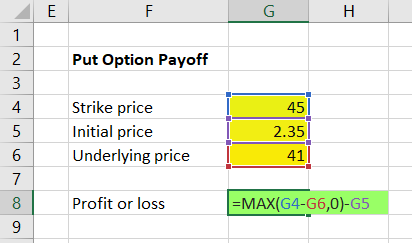

Web To calculate profits or losses on a call option use the following simple formula. Call Option ProfitLoss Stock Price at Expiration Breakeven Point For every. Web To convert this figure into a percentage value reflective of total return divide the profit by the total purchase price of the asset and then multiply the resulting figure by.

Call Option Example Meaning Investinganswers

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

Put Option Payoff Diagram And Formula Macroption

Options Strategy Payoff Calculator Excel Sheet Option Strategies Payoff Strategies

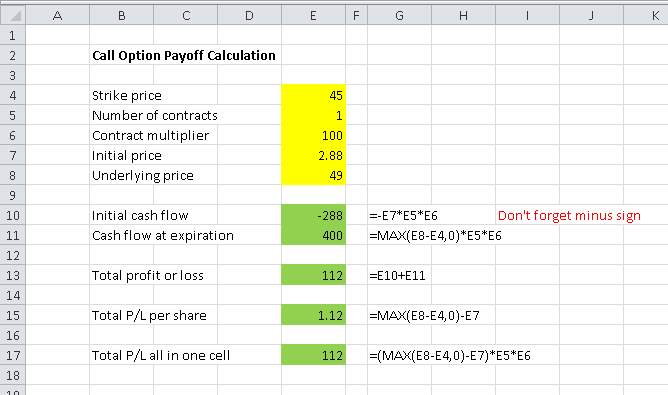

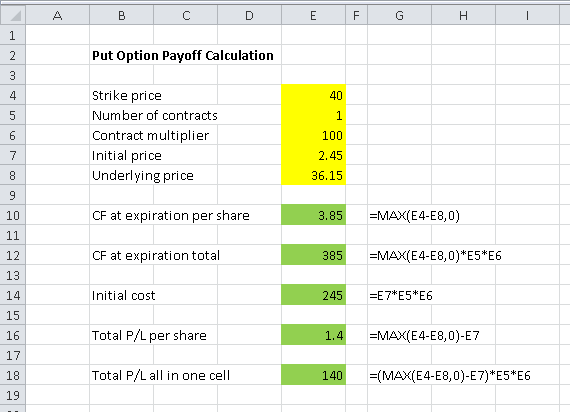

Calculating Call And Put Option Payoff In Excel Macroption

Calculating Call And Put Option Payoff In Excel Macroption

Calculating Call And Put Option Payoff In Excel Macroption

Call Option Profit Loss Diagrams Fidelity

Call Option Understand How Buying Selling Call Options Works

Call Option Payoff Diagram Formula And Logic Macroption

Dp Profit And Loss Problems For Up Police 2018 28 01 18 Http Www Mahendraguru Com 2018 01 Dp Profit And Loss Prob Study Materials Math Mathematics

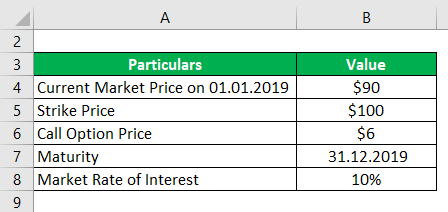

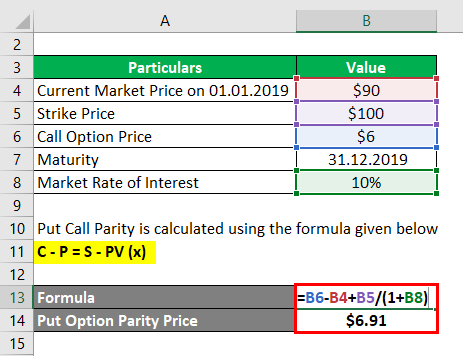

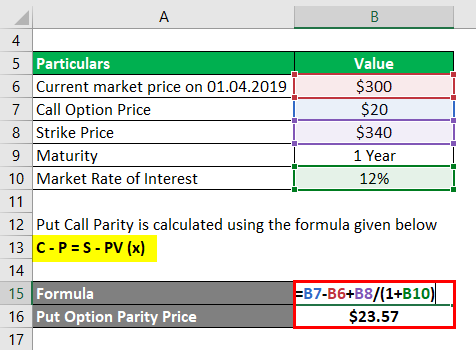

Put Call Parity Formula How To Calculate Put Call Parity

Amibroker Knowledge Base Quickafl Facts Facts Stock Data Exponential

Put Call Parity Formula How To Calculate Put Call Parity

Covered Calls What Works What Doesn T Covered Calls Covered Call Strategy Call Option

Put Call Parity Formula How To Calculate Put Call Parity